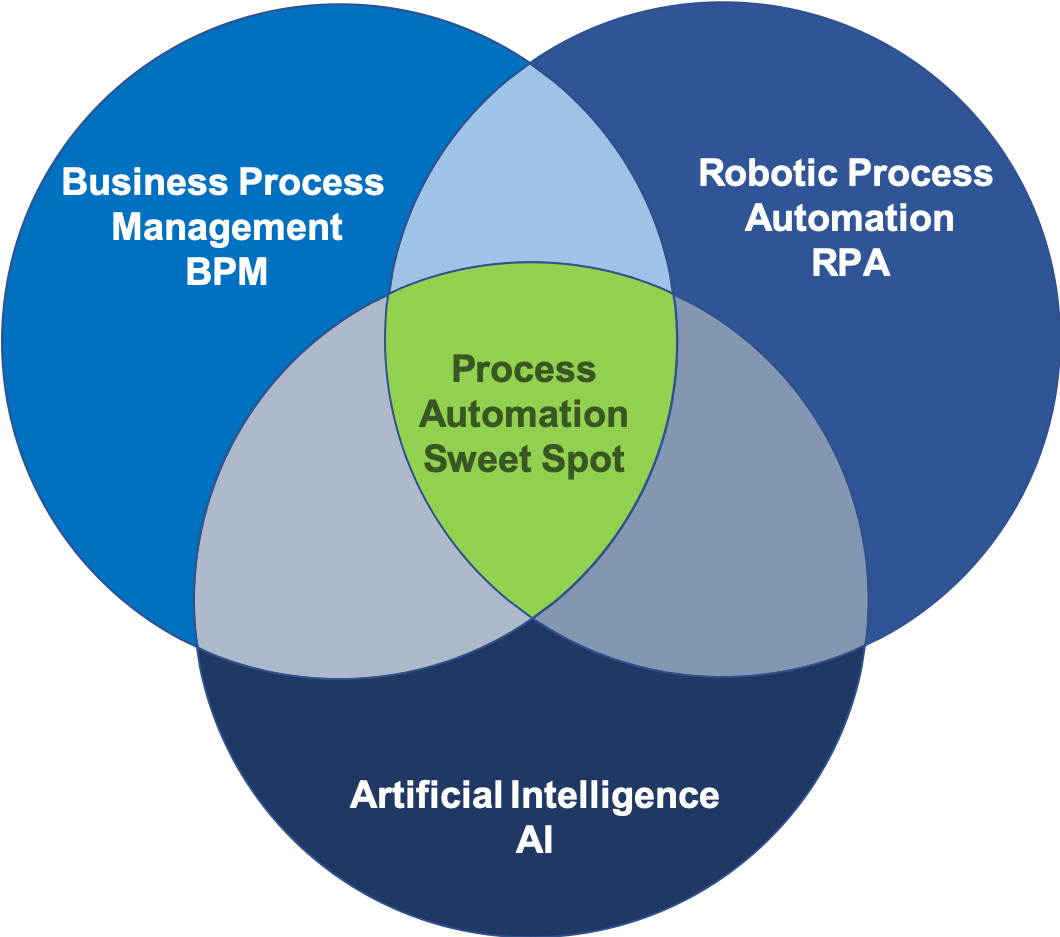

How to Discover Your Process Automation Sweet Spot

The phrase “Sweet Spot” has its roots in sports and refers to “the spot on a club, racket, bat, etc., where a ball is most effectively hit.”. In Economics, it is defined as “the point at which an indicator or policy provides the optimal balance of costs and benefits”. Translating these definitions, to the world of Process Automation, I would like to think of Intelligent Process Automation as “the right combination of Business Process Management, Robotic Process Automation and Artificial Intelligence that delivers an optimal balance of cost and benefits.” Achieving this will result in experiencing the Process Automation Sweet Spot.

First, some background

A few years ago, there was a lot of conversation about the newest kid on the Process Automation block – Robotic Process Automation (RPA) and how it will radically transform the way we work. As RPA became mainstream, there were debates on whether traditional BPM solutions are still relevant and if they will be replaced by RPA. Now that the dust on these debates has settled, the prevailing consensus is that both technologies are complementary and not mutually exclusive. We have also seen an upsurge in practical use cases for Artificial Intelligence (AI).

More recently, Gartner identified hyperautomation as the number one trend in it’s Top 10 Strategic Technology Trends for 2020. In this post, it defined hyperautomation as “the combination of multiple machine learning (ML), packaged software and automation tools to deliver work”. The research and advisory company also clarified that hyperautomation is not RPA alone, but rather a combination of tools such as RPA to replicate humans in getting work done.

The challenges

The future of work will be highly automated, and for executives charged with the responsibility of making this happen in their organisations, success will largely depend on getting the combination right. This is no easy task, as this responsibility also comes with challenges such as budget constraints, rapidly evolving technology, attracting and retaining tech talent and a rapidly changing business landscape.

Also, the task of digital transformation is further complicated by the need to keep existing legacy systems and processes operational. Today’s IT leaders have to deliver innovation that disrupts their company’s industry, without disrupting the company’s day-to-day operations. How do you as an IT leader navigate this rapidly changing Process Automation landscape? In this article, I propose a couple of strategies I hope you will find helpful and help you get started.

Some of the tools and real-world benefits

Before going further, let us first take a look at some of the technology tools available to you today. As mentioned earlier, my goal is to help you find the process automation sweet spot for your organisation by adopting intelligent process automation (IPA). IPA, however, is not a single tool but a combination of various technologies.

Business Process Management (BPM)

Having had the privilege of implementing BPM solutions for a number of clients in the financial services industry in sub-Saharan Africa, as part of their digital transformation roadmap, I have witnessed first-hand how they have been able to use BPM to radically transform the way they work. Business Process Management primarily helps businesses automate approval-based workflows. If you have a physical form that has to be filled and signed by two or more people as part of a process, it is an ideal candidate for BPM automation.

BPM has many benefits. One client saw a savings of over $50,000 monthly from automating just two processes. Another client was able to automate close to 200 processes over a 2 year period saving millions of dollars in software licenses while significantly improving the efficiency of its operations. Implementations take a few months and the ROI is often felt quickly. Care must, however, be taken to avoid implementations with unrealistic expectations. More on this topic later.

Robotic Process Automation (RPA)

The next tool in our toolbox is Robotic Process Automation. We are seeing RPA freeing up valuable employee man-hours by automating manual tasks such as posting transactions from Excel to internal or external applications. Another common use case is integrations with systems that do not have an API. By having a robot replicate the way a human interacts with the system, organisations are able to automate and integrate legacy systems with other applications.

Business photo created by kjpargeter – www.freepik.com

A common reaction we get in the early stage of engaging clients in an RPA project is the concern from employees that they are being replaced by robots. However, we like to think of RPA as freeing humans to focus on more value-adding work. Rather than getting bored from working on manual and repetitive computer-centric tasks., employees’ time can be freed-up for more value-adding work such as human interactions, engaging customers, empathy; things that the machine cannot do – as yet.

Artificial Intelligence (AI)

That said, we have Artificial Intelligence (AI), where machines are now able to analyze vast quantities of data and make predictions or make correct guesses about the information being analysed. AI is a broad term that encompasses Machine Learning and Deep Learning. The main point being, computers can offer us cognitive functions such as understanding what we say (NLP), recognising what we show it (Image recognition) and more.

Take image recognition, for instance, you want it to look at a picture and say “Yes, this is a face of a person”, or being able to look at an image and say “Yes, this is a driver’s license”. Also, we now have chatbots that can engage with customers and help employees as digital assistants. These are some of the capabilities AI is delivering to enterprises today.

So, where do you begin?

The three technologies and tools mentioned above are not exhaustive, but form a core part of the Intelligent Process Automation landscape. Now, given these transformational technologies, the following questions surface. Which one should I start with? Is it AI, RPA or BPM. Do they replace each other? How do I work with a limited budget?

The plethora of marketing from the various OEMs (the companies) providing these solutions often end up leaving you confused. The salesperson often positions their offering as the silver bullet to all your automation needs. You hear phrases like “With this technology, you won’t require any other tool”.

In my experience, I have found that not to be the case. Successful digital transformation programmes incorporate more than one solution. What I believe is the more important question is asking yourself, “how do I find the sweet spot of digital transformation?”. My answer to the initial questions posed

Which one should I start with? BPM, RPA or AI?

The answer is “it depends”? Every organisation is unique even in the same industry. The level of Process Maturity and the systems and solutions currently used in the organisation will inform the decision. However, of the three solutions, I think BPM is a good place to start for organisations who do not currently have any automation technologies deployed. A word of caution here, it is essential to standardise (or re-engineer) the processes before automation.

The reason I recommend starting with BPM is that it is the least disruptive and often provides a base platform that the other technologies can build upon. Later on, I will illustrate this with a sample journey from a manual process to one that is automated end-to-end through Intelligent Process Automation.

That said, there are other scenarios where RPA might be the more appropriate tool to start with. If you already have systems deployed that require a significant amount of structured and repetitive input from people, or a lot of Excel manipulations, then RPA is just the right tool. A guiding principle is to find low-hanging fruits that help the business see the value of automation, thereby helping to secure buy-in for scaling your digital transformation programme.

Do they replace each other?

The technologies are not mutually exclusive. They are more often than not complementary. In implementing Intelligent Process Automation, you can think of BPM as a digitalisation platform allowing you to replace physical forms with automated workflows, RPA as the workhorse that eliminates repetitive tasks while AI adds a layer of intelligence for decision making. All working in tandem to increase the organisation’s efficiency.

How do I work with a limited budget?

This all sounds good, but right now, you are thinking, “I barely have enough budget to keep current systems operational”. I would like to recommend what I call the Community to Enterprise Approach. It basically involves starting with the community edition (or free-tier) of a solution to automate a process that demonstrates value to the business.

I have worked with a few organisations who have adopted this approach. In one case, we helped the CIO train a few of his developers on the community edition of a BPM solution. Then with that training, they were able to automate a couple of processes which yielded a significant increase in the operational efficiency of the departments using the processes. Having seen the benefits, they wanted to automate more processes. This helped the CIO get an approved budget for the purchase of the Enterprise Edition of the platform since a higher level of support will be required if additional processes were added to the platform.

Another way to keep your deployment costs low is to invest in building internal capability. Training your team on the technology is much more cost-effective than having a consulting firm like ours automate all the processes. Our most successful implementations have been those where we train the client’s in-house team and then they work together with our team of consultants to automate the initial set of processes. This helps them deepen their understanding of the technology, take ownership and scale it as they identify opportunities in the business that are a good fit for the platform.

Automating an Account Opening Process

A good way to understand the concept is to illustrate it with a sample process. Let’s take an Account opening process as an example. In most developing countries in Africa, you do not yet have that much technology penetration and most of the identity verification systems do not have readily available APIs banks can integrate with.

The challenge

For our purpose, ACME Bank has decided to automate its account opening process. The current practice at the bank is for customers to walk into a branch and fill out an account opening form. The bank performs its KYC process and then if all checks out, it opens an account for the customer and sends him the details of his account within 24 hours.

However, due to growth in the number of new customers and more regulatory requirements from compliance, the process now takes longer, resulting in customers waiting up to 72 hours to receive the details of the newly opened account. The bank’s management is worried and has mandated that process be automated to ensure the process stays within the promised 24 hours SLA.

The brilliant idea

The Business Process Improvement department comes up with a very brilliant idea to make the entire account opening process digital. We want our customers from the comfort of their mobile devices to be able to just open an account.

From the comfort of her home or office, the customer takes her device, downloads a mobile app, fills in her details on the phone, takes a picture of her ID also and a picture of her face, and then submits it to the bank through the mobile app. The request is received by the bank, processed and the customer receives the account details notification.

However, there is a snag. The bank’s compliance department requires that someone needs to verify that the information is valid, which is often known as the KYC process – You’ve got to Know your Customer. The IT team proposes generating a PDF file that is accessible to the Compliance team via a portal to download for verification using their current process. If all is good, the request is updated on the portal and the mobile app middleware generates an account number and sends to the customer.

So that is a bit of automation. The bank has been able to eliminate the step of having the customer physically coming to the bank to open an account. However, that introduces its own problem. The compliance team has to manage some compliance checks on the portal and others through files sent to them from branches. The team thinks there has to be a better way. And there is.

Business Process Management to the Rescue

One of the primary benefits of a Business Process Management solution is that it allows organisations to eliminate silos and building many different portals and applications. By providing a low or zero code, rapid application platform, many business applications can be built on the system without having to develop different portals thereby saving the business time and money.

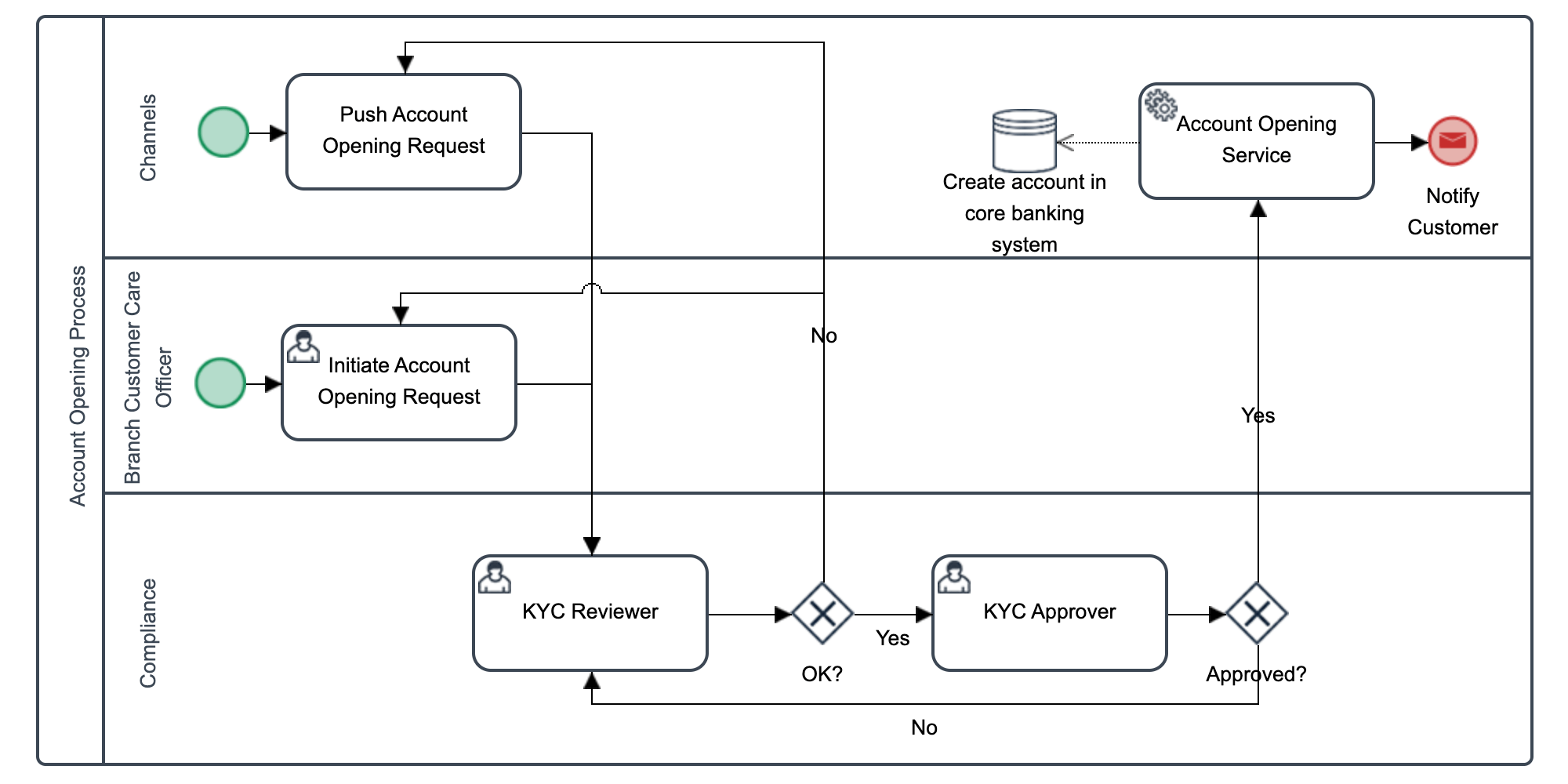

With Business Process Management, rather than building a portal for the compliance team to make their checks, the bank can design and build out the process on the BPM platform. This allows the process to be standardised irrespective of the channel (a branch, mobile app or other channels added later like chatbots) that the account opening request originates from.

In a sample process model like the one shown in the image below, we can readily see some efficiency gains introduced into the process. By having all the data from the account opening process in a single platform, the bank now has a central system for capturing all account opening documentation and performing compliance verifications.

Document Digitization

Physical documents brought to the branch are captured by the branch customer care officer and uploaded into the system as part of the process. This can be further enhanced by integrating the scanners directly into the BPM platform. Documents uploaded by customers using the mobile app are also pushed into the system. These documents can then be readily retrieved in the future from the system enabling the bank to comply with the regulator’s document retention policies.

Maker-Checker or Dual Approval

In most banks, we have something you call a dual approval or four-eyes or maker-checker principle. This basically means ensuring that someone else vets and approves a transaction or request before it is processed. The system ensures that another compliance officer reviews the verification done by every compliance officer. This helps mitigate risks like human error and fraud from collusion.

SLA Monitoring

Another value that the Business Process Management system introduces is visibility into how long the process really takes and which tasks are the bottlenecks. Out of the box, the BPM platform shows when a request was sent from the branch or mobile app. It also shows when the compliance team started working on it, and how long it took. The bank can now clearly see if the 72 hours is a result of compliance verification delays or delays from the branch when requests are sent back for additional documentation or clarification.

Standardised Customer Communication

Lastly, the bank is also able to have a standard way of communicating with their customers irrespective of the channel the customer chooses to request for a new account. This helps the bank ensure that the customer’s experience is the same.

Reviewing Our Progress

Now, let’s take a moment to review the first phase of our intelligent process automation implementation which uses only BPM. We have a mobile application or public-facing channel that feeds the bank’s backend system which is the business process management platform. With this automation, the bank notices a slight improvement in the process, but customers are still not receiving their activated accounts within the promised 24 hours SLA. Oh, dear! What can the matter be?

Compliance verification bottleneck

Fortunately, the BPM now allows us to track every request from beginning to end. A review of the data from the previous month shows that the delay is coming from the compliance team. In their defence, the compliance team shows that the verification process is time-consuming.

What the officer is doing is reviewing the picture that was uploaded and saying “Yes, this is a human face, it is a picture”. Next, he looks at the ID that was uploaded and compares the picture on the ID to the picture of the customer. But that’s not all. He has to:

- determine that the identification is valid. The authorities issuing the accepted IDs do not have an API for integration, so he has to determine the type of ID, log in to the corresponding website, enter the ID number and check the validity. For example, if it’s a driver’s license, he’s going to the motor licensing authority website and put in the ID to check.

- check that the name on the ID matches the name of the customer

- check that the date of birth matches what the customer has provided

- check that the ID has not expired

All that takes a bit of time. It’s taking compliance officers 5 to 10 mins to complete all of that process but they admit it is much better having the documents on a system as opposed to having physical documents that they have to carry from one desk to another. The compliance head also likes that the maker-checker is built into the system, ensuring his team do not breach the regulatory policy. Compliance proposes hiring more people, but the technology team has a better idea.

Going beyond BPM with RPA

The technology team has been exploring Robotic Process Automation and believe this problem might just be a good fit. RPA allows you to deliver end-to-end automation, even where there are no APIs for integration by replicating the way humans interact with the system. The team’s idea is to use a robot to perform the task of verification from the ID issuers website.

The robot can download the ID, extract the ID number, log on to the website to verify and paste the results of the verification in the form for the compliance officer. This sounds fantastic! However, someone is quick to point out that the team might be forgetting something. There are various forms of IDs issued by different authorities. How will the robot know which website to perform the verification?

Someone suggests having the customer indicate the type of ID. That way, the robot looks up the ID type field and determines if the ID document is a passport, driver’s license or other accepted type of ID. “What if the customer or branch customer care officer makes a mistake and selects the wrong ID type?” someone else asked. Well, maybe AI can help.

Hyperautomate with Artificial Intelligence

The recent advancements in Artificial Intelligence have brought about innovative solutions like image recognition and natural language processing. Systems are able to understand human speech and recognise objects in images. Combining an image recognition service from Microsoft, Google IBM or other AI service provider with the process will enable the robot to determine which type of document has been uploaded.

The hyperautomated process

It’s a Eureka moment. The project team is excited and comes up with a new design of the process. The new process introduces the following enhancements

Face detection and verification

Images uploaded to the photo field are instantly sent to the AI service to detect if indeed it’s a human face. This eliminates customers uploading pictures of goats as their passport photos. Also, the photo on the ID document is compared with the image uploaded to verify that the face on both images is the same.

Document classification

Using an image classification service, the image uploaded as an ID is analysed and classified. The classification labels the document a driver’s license, international passport or other ID types the service has been trained to identify.

Data extraction and verification

Based on the classification of the ID, a robot extracts the essential details such as the ID number, expiry date, name and date of birth from the document using OCR. The robot then logs in to the appropriate website to verify the ID. The result of the verification is also updated on the system and the robot routes the request to the compliance team.

Information accuracy and validation

The BPM platform uses pre-defined rules to check the accuracy of the extracted information and also perform validations based on business rules. For example, the name and date of birth on the ID are compared with the data inputted by the user and inconsistencies are flagged. Other validations like ID expiry date, the age of the customer are also performed.

Automated and instant feedback

The new process also provides instant and faster feedback to the user at the point of data capture. Rather than wait several hours or even days for the request to be reviewed by a compliance officer, the immediate checks are automated and the user gets instant feedback on the data uploaded and the result of advanced verification are communicated in minutes.

Exception review and continuous improvement

For the rare scenarios that the system is unable to properly classify or for which the AI confidence score is low, the request can be routed to a human to review. This provides a safety net for handling exceptions. Furthermore, the decisions made after the exception is reviewed can be used to improve the process.

For example, if a certain document is being tagged a passport with a confidence score of 70% and not meeting the minimum score of 90% required in the process, a human review can reveal that the low score is a result of a new change in the document design. The IT team updates the classification service with this new data and the system is now able to properly classify the document.

Benefits of Intelligent Process Automation

As we can deduce from the hyperautomated process delivered through Intelligent Process Automation described above, the bank will be able to experience significant benefits such as

- Better user experience on the digital channels

- Reduced turnaround time for processing account opening requests allowing the bank to meet the promised 24 hours SLA. Compliance officers no longer have to log in to different systems to perform checks and can focus on other value-adding work.

- Cost-savings. Rather than hiring more people to meet the increased workload, the automated system can keep working past regular working hours, as the bots and services run 24 hours, 7 days a week without needing breaks or vacations.

- Process standardisation for both physical and digital channels

- Centralised document archive. This can be valuable in retrieving documents for future investigations and complying with document retention policies.

- Increased regulatory compliance

Conclusion

While the process described above is hypothetical, the illustration shows how organizations can go beyond automation to hyperautomation. By combining Business Process Management, Robotic Process Automation and Artificial Intelligence technologies, organisations will be able to deliver true end-to-end automation which will be hard to achieve using these technologies independently.

We have also been able to show that limited budgets should not be a barrier to organisations looking to improve or digitally transform as they can adopt a Community to Enterprise approach. We also saw the benefits of developing in-house capacity on these technologies rather than depending solely on external consultants for their digital transformation.

Although this article primarily focuses on Business Process Management, Robotic Process Automation and Artificial Intelligence, there are other technologies like Process Mining and Enterprise Content Management that can be combined to deliver hyperautomation.

P.S.

I would like to learn more about how you are combining these technologies in your organisation. The successes and challenges as we all learn together. If you would like to me to put together a demo of the hypothetical process described, please leave feedback in the comments.